|

SmartFolio Professional Edition

SmartFolio is a state-of-the-art asset management software for investment professionals and private investors.

It contains advanced portfolio optimization and risk management techniques, based on the latest achievements

in portfolio theory. The software combines highly advanced and innovative analytics with a user-friendly,

intuitive interface, perfectly suited to any level of expertise and experience.

SmartFolio is a state-of-the-art asset management software for investment professionals and private investors.

It contains advanced portfolio optimization and risk management techniques, based on the latest achievements

in portfolio theory. The software combines highly advanced and innovative analytics with a user-friendly,

intuitive interface, perfectly suited to any level of expertise and experience.

Most of the mathematical algorithms utilized by SmartFolio have only emerged in the last few years.

Many are therefore not to be found in other commercial products.

SmartFolio will help you solve a variety of practical tasks including:

Asset performance ranking ;Identification of investor’s goals;

Portfolio optimization; Efficient frontier construction ;

Analysis of portfolio risks;Analysis of target shortfall probabilities;

Minimization of transaction costs that arise during rebalancing.

| Software Information |

System Requirements |

| Version: |

2.0.2 |

- Windows 2000/XP/2003/Vista

- Additional software: Excel 2007/2003/XP/2000

- Pentium II CPU

- 256 MB RAM

|

| License: | Free to try, $490 to buy |

| File Size: |

8.73 MB |

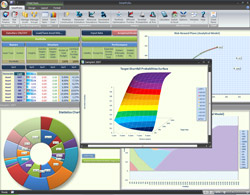

| Screenshot : |

View Screenshot |

| Rating : |  |

Key Features of SmartFolio Professional Edition:

- General

Fully supports the multi-period investment paradigm.

Fully supports portfolios featuring assets with non-Gaussian distribution of returns,

or non-linear inter-dependencies, including options and hedge funds. This is achieved

through direct simulation of portfolio dynamics with no model assumptions.

- Portfolio Construction

Simultaneous creation of two environments for portfolio analysis:

Analytical environment: logarithmic price increments are assumed to be

independent normally distributed random variables.

Historical environment: optimization and other procedures are based directly on historical prices.

Risk-free asset option.

Factor-selection option for a factor-based asset pricing model.

- Estimation of parameters

Stambaugh combined-sample estimates, used if asset histories differ in length.

Jorion expected-returns estimate, which shrinks sample average returns to a common value.

Ledoit-Wolf covariance-matrix estimate, which shrinks the sample covariance matrix to the

constant correlations covariance matrix.

Pastor-Stambaugh-Wang joint estimate of expected returns and covariances, which shrinks

sample estimates to their respective counterparts, implied by the selected factor model.

MacKinlay-Pastor joint estimate of expected returns and covariances, based on the

assumption that prices are explained by an unobservable factor.

- Portfolio optimization

Three optimization criteria:

- Maximization of an expected utility with constant relative risk aversion

- Minimization of target shortfall probability

- Benchmark tracking.

Worst-case scenario optimization: the resultant portfolios demonstrate optimal

behavior under the worst-case scenario.

Optimization engine based on IPOPT (Internal Point OPTimizer) — one of the most

powerful nonlinear optimizers available today.

- Target shortfall probabilities analysis

Calculation of target shortfall probabilities according to selected ranges for the

investment horizon and target rate.

- Value-at-Risk analysis

Simultaneous calculation of two risk measures: Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR).

Various techniques for calculation of VaR and CVaR, including:

- Delta-Normal Method (DNM)

- Empirical distribution

- Implied normal distribution

- Implied non-central t-distribution

- Cornish-Fisher expansion.

Construction of VaR and CVaR surfaces according to selected ranges for the investment horizon and significance level.

- Historical simulations

Simulations of portfolio strategies with continuous rebalancing.

Simulations of portfolio strategies with continuous rebalancing and portfolio insurance

— these strategies are optimal in a situation when a predetermined portion of the initial

wealth and/or accumulated profits must be maintained.

Portfolio-strategy simulations with "inaction region" rebalancing — these strategies are

optimal in the presence of proportional transaction costs.

Portfolio-strategy simulations with "inaction region" rebalancing and portfolio insurance.

- Data management

Choose either an Access-database or Excel spreadsheet format to store your data.

Import historical data from a text file or download it from Yahoo!Finance.

- Miscelaneous

"Three-fund" portfolio calculation — utility-based portfolio, optimal in the presence of

an estimation error in the model parameters.

Utilization of Block Bootstrapping algorithm in the calculation of VaR, CVaR, and shortfall probabilities.

Determine Inaction region optimal size in the presence of proportional transaction costs, based on a multidimensional extension of the Davis-Norman approach. [pdf]

Wide range of optimization constraints, which also include:

- Constraints on assets groups

- Highly non-linear margin constraint to account for margin requirements in portfolio components.

Various performance measures including Information ratio, Sortino ratio and STARR ratio.

RELATED SOFTWARE DOWNLOADS FOR SMARTFOLIO PROFESSIONAL EDITION

- Portfolio Optimization

The Portfolio Optimization template calculates the optimal capital weightings for a basket of investments that gives the highest return for the least risk

- PortfolioTK

Portfolio Tool Kit provides an advantageous way of looking at your portfolio of investments.

- XL Fusion 3.0.4

is used for merging several electronic worksheets into one worksheet automatically

- CuteTrader - Portfolio Builder/Analyzer

CuteTrader - Portfolio Builder/Analyzer:Diversify your portfolio globally and trade only the leading sectors..

- Portfolio Optimization

The Portfolio Optimization template calculates the optimal capital weightings for a basket of investments that gives the highest return for the least risk

- PortfolioTK

Portfolio Tool Kit provides an advantageous way of looking at your portfolio of investments.

- XL Fusion 3.0.4

is used for merging several electronic worksheets into one worksheet automatically

|

|

SmartFolio is a state-of-the-art asset management software for investment professionals and private investors.

It contains advanced portfolio optimization and risk management techniques, based on the latest achievements

in portfolio theory. The software combines highly advanced and innovative analytics with a user-friendly,

intuitive interface, perfectly suited to any level of expertise and experience.

SmartFolio is a state-of-the-art asset management software for investment professionals and private investors.

It contains advanced portfolio optimization and risk management techniques, based on the latest achievements

in portfolio theory. The software combines highly advanced and innovative analytics with a user-friendly,

intuitive interface, perfectly suited to any level of expertise and experience.

BestShareware.net. All rights reserved.

BestShareware.net. All rights reserved.